Charitable Gift Annuities

You can make a generous gift and receive a stream of payments to you and/or a loved one—all while generating valuable tax benefits.

How it works:

How it works:

- JFCS promises by contract to pay you and/or a loved one fixed payments for life in exchange for a gift of cash or securities

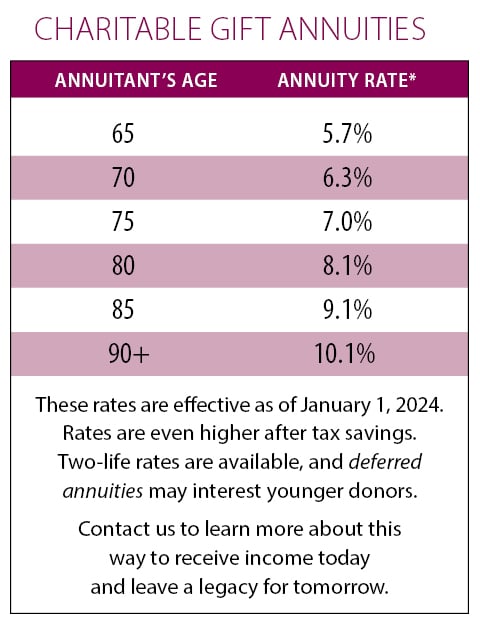

- Amount of payments is based on your and/or your beneficiary’s age and the value of the donated asset

- After your lifetime(s), the remaining balance passes to JFCS

Your benefits include:

- Income for you and/or a loved one for life

- Immediate income tax deduction for a portion of your contribution

- A portion of future payments may be tax-free

- Favorable capital gains treatment for appreciated securities

- Flexibility to start payments immediately or defer to a later date

- Favorable payout rates

- Security of your investment being backed by JFCS and not affected by market fluctuations

How to make your gift:

- Minimum gift of $10,000 by someone 65 or older

- Contact us for a personalized illustration of your payout rates and tax advantages, with no obligation

As with other important financial decisions, you may want to consult legal and financial professionals for advice.